Aquatech China 2024 – membranes, PFAS and more

Simon Judd has over 35 years’ post-doctorate experience in all aspects of water and wastewater treatment technology, both in academic and industrial R&D. He has (co-)authored six book titles and over 200 peer-reviewed publications in water and wastewater treatment.

1. Aquatech China and SNIEC

Aquatech China began life in 2008, but has only this year moved to the Shanghai New International Expo Center (SNIEC). SNIEC is a very substantial venue of 17 large halls, only three of which were required for the Aquatech event (and, for the bulk of the event, just the first two halls).

The event is touted as the largest water-dedicated trade show in Asia and lasts for three days. It includes a small number of topic-specific presentation sessions with invited speakers running alongside the exhibition, with simultaneous translation between English and Chinese for every session. Admission to the entire event is free.

2. Membrane technologies at Aquatech China

As with all events dedicated to water and wastewater treatment technology, all manner of equipment was in evidence: pumps, blowers, valves, tanks, meters, control systems – most of the things one would expect to come across in a water/wastewater treatment plant. The most prevalent technology, however – the one featuring more than any other at the exhibition – was the domestic water treatment unit. Around 75% of the booths in Hall N2 were filled with either gleaming above-counter units or below-counter unit components such as UF and RO membrane filter cartridges, media filters, and taps/fittings. This reflects the popularity of domestic water treatment in China.

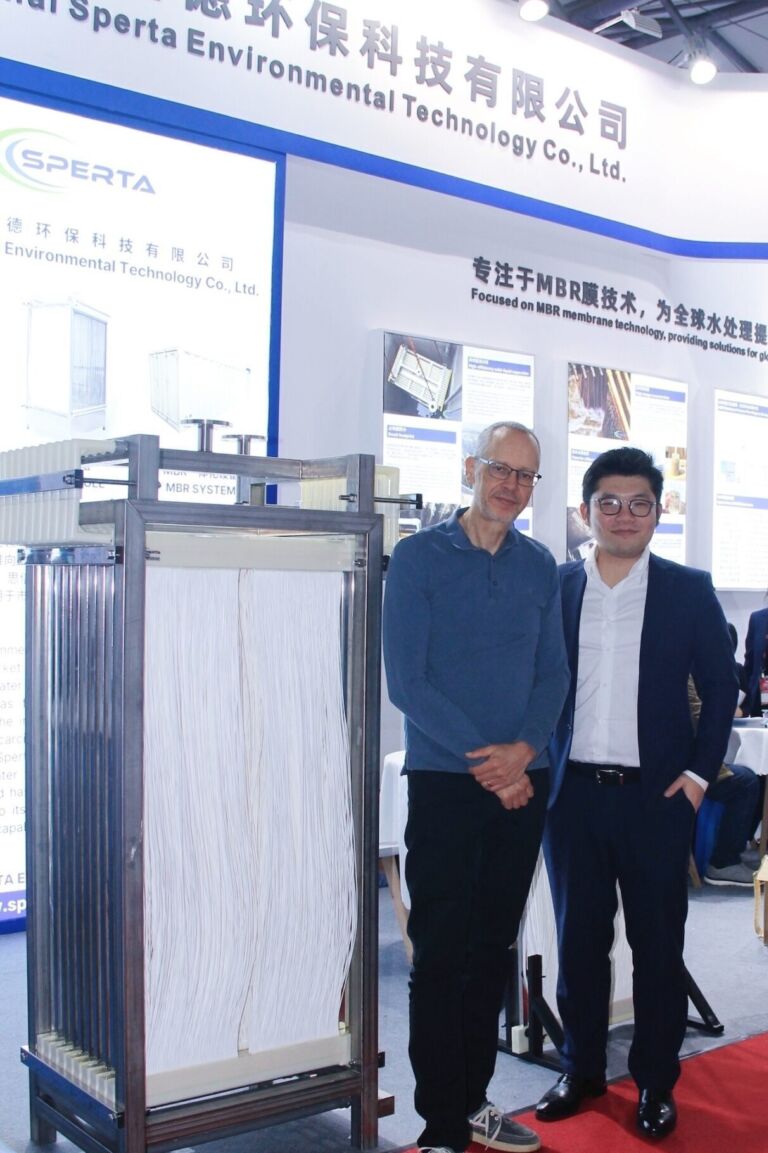

My focus, of course, was primarily on membrane technology generally and MBR membranes in particular. Pounding the exhibition floor in the designated 'Membrane' and 'Water/wastewater treatment' areas of Hall N1 revealed a preponderance of RO modules. However, the majority of Chinese membrane suppliers appear to offer a range of membrane technology modules: RO, UF and MBR. Of those offering MBR membrane modules the most prevalent configuration was the hollow fibre (HF). Exhibiting suppliers offering this membrane type include Canpure, Litree, Jiangsu Aidemans (ADM), Nantong Delta, Rich Kirin, Shanghai CM, Shanghai Morui, Shanghai Sperta, Shuiyi, Tanal and Xiamen Top Fluorine. Of the other configurations, Hipure and Suzhou Kaho offer tubular membrane modules and Shanghai Sinap rigid flat plates (and, in the near future, composite flat sheets).

Chinese suppliers generally are always pursuing international markets, and there are now many references in the North America, the MENA region, Australia and Europe, as well as in South East Asia (including developing markets such as Indonesia and Vietnam). One driver for the implementation of MBR technology specifically within China, however, is in the state funding for wastewater treatment.

In China sewage treatment is funded, by the government or end users, on the basis of the volume of wastewater treatment. The funding level varies with the region, treatment technology, wastewater quality, and local policies.

| Factor | Category/Type | Example | Notional fee, RMB/m3 | Note |

|---|---|---|---|---|

| Region | Tier 1 Cities | Beijing, Shanghai, Guangzhou | 1.0–2.5 | Cost typically covered by government subsidies or collected as part of user water fees |

| Tier-2 & Tier-3 Cities | 0.8–1.5 | More economically developed areas tend to offer higher subsidy levels and fees | ||

| Less developed/ rural regions | 0.5–1.0 | Projects sometimes fully reliant on government subsidies | ||

| Treatment technology | Conventional | A2O, oxidation ditch | 0.8–1.5 | Lower treatment costs |

| Advanced | MBR, biofilm | 2–3 | Higher treatment costs | |

| Wastewater quality | Domestic sewage | Up to 2.5 | Lower treatment costs | |

| Industrial effluent | 3 or more | Higher treatment costs |

The figures are often influenced by local government regulations issued by environmental or development and reform commissions. Some local governments provide additional subsidies based on environmental protection policies, reducing the actual payment burden on users.

Operational costs (OPEX) of municipal wastewater treatment plants may be linked to Public–Private Partnership (PPP) agreements signed with local governments. As is usually the case, OPEX is higher for smaller plants.

The municipalities or other end users are motivated by low capital costs. It is therefore prudent for the membrane manufacturers to produce both high-end and lower-end products – in much the same way as car producers will often offer both luxury and budget-range models. The lower-cost HF products are fit for purpose, but are not necessarily as robust as the high-end products: cost-saving measures are taken such as reduced amounts of PVDF coating and less adherent bonding of the PVDF to the sub-layer. This is perhaps the root of the widespread misapprehension regarding Chinese membrane products. Chinese manufacturers have the capability of producing robust membrane materials, and such products are commercially available from them, but also produce less robust products to meet the CAPEX-sensitive needs of the domestic market.

3. PFAS and domestic water supply

As with almost all polymeric membrane suppliers, the material of choice for MBRs was PVDF: there was little evidence of any alternative material being offered. It seemed appropriate, then, to take the opportunity to find out more about some of the US regulations relating to PFAS – a contaminant whose profile has risen dramatically in the past 2–3 years. The exhibition included a session by the IAPMO (the International Association of Plumbing and Mechanical Officials) on US domestic water treatment trends and regulation.

The EU is currently considering banning the production and use of PFAS products, potentially including polymeric materials such as PVDF. The USEPA is to introduce limits for PFAS in drinking water in 2027, with compliance required by 2029. For the most commonly-referenced PFAS substances, perfluorooctanoic acid (PFOA) and perfluorooctane sulfonate (PFOS), the USEPA maximum contaminant level (MCL) is 4 ppt.

The talk on PFAS testing requirements and standard updates, by Brian Donda, was part of the IAPMO session. The focus of the presentation was very much on the regulations, the challenges imposed, and the treatment options and their efficacy. RO was identified as being the most effective treatment technology, achieving up to 97% removal of PFAS based on a number of different studies. The talk was very informative, as was the opening talk by Thomas Palkon.

It's perhaps worth mentioning that whilst protecting the domestic consumer from PFAS, the main focus of IAPMO in this context, the use of RO does little to address the adverse environmental impacts of PFAS. The RO concentrate stream is discharged to sewer, where it is re-diluted and eventually fed to the municipal wastewater treatment works. It is well known that little PFAS removal takes place at WwTWs, such that the PFAS is substantially discharged back into the environment with the treated effluent.

The main alternative to membrane separation for PFAS removal from domestic water, activated carbon or some other adsorbent, would normally require disposal of the spent adsorbent material once exhausted. This is obviously problematic since it contains high levels of PFAS. However, it occurred to me that since the PFAS is at least partially concentrated on a solid matrix at this juncture then this presents the possibility of mineralising the PFAS (either thermochemically or by electro-oxidation) while regenerating the adsorbent. Presumably, the infrastructure required for the collection and regeneration of filters on a national scale precludes it as an option, but it is this sort of concentration-elution-destruction two- or three-step process which is ultimately required for complete PFAS decontamination.

4. Aquatech China vs WEFTEC and IFAT

Aquatech China is not quite as large as the regular Aquatech and WEFTEC, and certainly not as large as IFAT. The programme of presentations seems to be largely limited to the exhibition sponsors, and is less expansive than the programme at WEFTEC. The exhibition at IFAT is huge: over 3000 exhibitors in 2024 compared with around 500 at Aquatech China and just over 600 at WEFTEC. IFAT and WEFTEC encompass all water and environment aspects, whereas Aquatech China is focused on water treatment.

It's nonetheless worth experiencing Aquatech China and the Chinese culture. Many overseas attendees do so as a way of making potentially valuable contacts with Chinese manufacturers and suppliers. In my case, it was largely just curiosity as well as an opportunity to hook up with some of our advertisers – but the experience was certainly positive.

Finally, it would be remiss of me not to mention our Chinese advertisers who attended the exhibition; it was great to meet up with Adams Li of Shanghai Sinap, Nancy Tao of Shanghai MegaVision and Kevin Chen of Shanghai Sperta in person. Special thanks to Nancy and Kevin in particular for their kindness and generosity: I don’t think I’ve ever eaten as well as I did over the course of the three days spent in Shanghai in their company.